Sales Revenue Is Recognized in the Period in Which

The staff believes that provided all other revenue recognition criteria are met service revenue should be recognized on a straight-line basis unless evidence suggests that the revenue is earned or obligations are fulfilled in a different pattern over the contractual term of the arrangement or the expected period during which those specified. On approval with a right of return.

I Am Happy To Be Part On This Incredible Journey How About You Please Visit Www Biocell Jeunesseglobal Com Or Send Email To Biocell55 Yahoo Com

Merchandise is delivered to the customer b.

. About 60 of the SECs actions taken against fraud uncovered by. The customer places the orderb. Revenue is the value of all sales of goods and services recognized by a company in a period.

The contract is recognized when goods are accepted or period of right of return has lapsed. Record sales on the orders that have not been shipped. If the customer is billed for 1200 the revenue recognized per period will be 100 each for 12 months.

Merchandise sales revenue is recognized in the period in which. In the Revenue schedule field select the revenue schedule that represents the period that the revenue must be deferred over. Record sales in the wrong period eg.

For example an online magazine selling a 144 annual subscription will recognize 12 as monthly revenue. The revenue recognition principle a feature of accrual accounting requires that revenues are recognized on the income statement in the period when realized and earnednot necessarily when cash. The merchandise is delivered to and accepted by the customerc.

The contract is recognized only when the consignee has sold the goods. According to the principle of revenue recognition revenues are recognized in the period when it is earned buyer and seller have entered into an agreement to transfer assets and realized or realizable cash payment has been received or collection of payment is reasonably assured. Cash payment on the account receivable is received by the sellerd.

Revenue recognition is the most common inherent risk in revenue accounts that can lead to an overstatement of revenues. Sales revenue is recognized in the period in which. Improper timing of revenue recognition is the most common type of accounting fraud the Securities and Exchange Commission SEC has taken action against under its whistleblower program say lawyers who work with employees whove come forward.

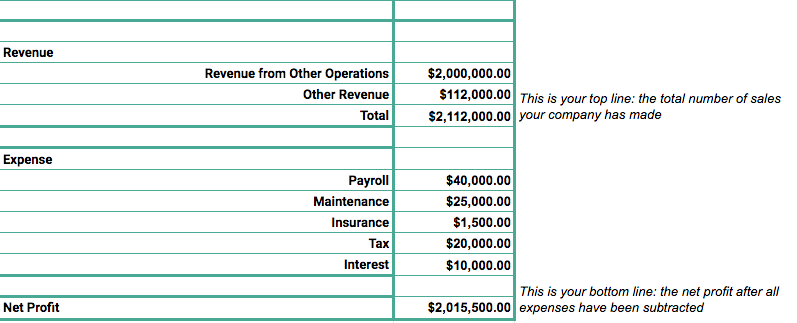

Income Statement The Income Statement is one of a companys core financial statements that shows their profit and loss over a period of time. The Blueprint breaks down the RRP. When it comes to revenue recognition the system uses the contract start and end dates to create equal buckets in which the revenue will be recognized.

Record sales that occur after year-end in the current year. Common sources of revenue and point at which recognition occurs. If you get paid to provide a service for a month or a year but you receive the money immediately that payment should be.

Purchases are made to replace the merchandise sold. Sales are neither assets nor liabilities. The transaction that triggers the revenue recognition is VF44.

QUESTION 18 Sales revenue is recognized in the period in which. Sales revenue is recognized in the View the full answer Transcribed image text. As of date of sale or delivery to customers.

Revenue recognition principle states that revenue is recognized when it is realized received in cash or realizable will be received in cash and earned the firm has performed its part of the deal. Months 9 to 12 have revenue recognised from the first purchase however once the upgrade is sold months 9-12 will have a new credits invoice and hence MRR of the total account will result in an. From a SaaS accounting perspective the revenue can be recognized only when the said productservice obligations are satisfied.

The customer places the. Cash payment is received by the seller d. Merchandise sales revenue is recognized in the period in which.

Businesses recognize revenue at the time of sale whether for cash or credit accounts receivable. The business cannot recognize revenue even after receiving money before the transaction is complete. 1 Identify the contract with a customer 2 Identify the separate performance obligations in the contract 3 Determine the transaction price 4 Allocate the transaction price to the separate performance obligations in the contract 5 Recognize revenue when or as entity satisfies a.

The revenue schedule is. Revenue also referred to as Sales or Income forms the beginning of a companys income statement. Recognized when you transfer control.

The revenue recognition principle or just revenue principle tells businesses when they should record their earned revenue. O Service is delivered to the customer O The customer orders the merchandise O Cash payment is received by the seller O Purchases are made to replace the merchandise sold QUESTION 19 Dividends will have what. The customer orders the merchandise c.

You can also define the setting for the released product on the Revenue recognition FastTab of the Released products page Revenue recognition Setup Inventory setup Released products. So in this basic example 1000 revenue can be recognized every month in return for the productservice delivered until the end of the contract. The physical inventory is taken2.

Revenue Recognition As an Accounting Principle Revenue recognition is a generally accepted accounting principle GAAP that identifies the specific conditions in which revenue is recognized. Record sales that did not occur yet eg. Insignificant part of the sales contract revenue can be recognized on delivery.

However we have an issue in the upgrade case in how to treat the revenue already recognised for the credits on the first contracts in the last 4 months of the contract ie. Sales is the operating revenue recognized for a company over a period of time. Even though the booking for the entire year is received upfront revenue is recognized equally across the 12-month period.

- Sales of products.

Sales Revenue Formula Calculate Grow Total Revenue

Sales Revenue In Accounting Double Entry Bookkeeping

Explain The Revenue Recognition Principle And How It Relates To Current And Future Sales And Purchase Transactions Principles Of Accounting Volume 1 Financial Accounting

No comments for "Sales Revenue Is Recognized in the Period in Which"

Post a Comment